Money Transfer from India to UK

Pay your tuition fees

Pay your university fees easily from your Indian bank account

Send money to an International Bank

Send money to an International Bank

Settle your Rent

Now pay rent to your landlord directly from your account in India

Why Choose Remigos for International Money Transfer?

Save Money With Best Rates

Get 5X superior rates than the market and save money.

No Paperwork, Fully Digital

No need to print out forms or visit banks

Super Fast Transfer

Whether you are sending $100 or $50,000, get in in just 24 hours.

No Hidden Fees

No more gimmicks or getting fooled by banks. Pay what you see.

100% Safe and Secure

Trusted by 1000s. Regulated by RBI. Guaranteed by us.

Hassle-Free Transaction

Super easy to use platform and 24*7 customers support available.

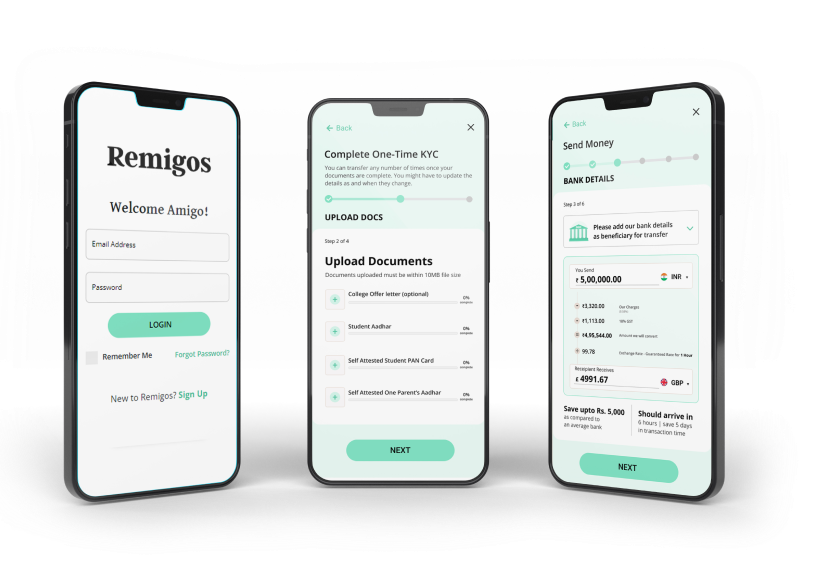

Now Send Money From India to UK From Your Smartphone!

Register in minutes

Sign up online, or on our app with an email address.

Verify your Identity

We’d just need your PAN card, Passport, Visa and College offer letter to verify your identity.

Transfer Money

Fill in the details of your recipient’s bank account and pay using bank transfer.

Track your Transfer

Easily track your transfer on our support. Get real-time updates Whatsapp.

Enjoy Safe and secure Money Transfer with Remigos

RBI Regulated

We are RBI regulated and supported by SBM bank to provide safe and secure money transfer services.

Audited Regularly

Your money is safe with us. We are regularly audited by RBI to safeguard your money.

Covered in Media

It's great to get recognized by London Business School, Indian Startup News and many more for the amazing work we are doing.

Extra-Secure Transactions

At Remigos, no one ever touches your money. You pay it directly to bank and its on the way to its destination.

Data Protection

Your personal data is always encrypted. We are transparent in how we collect and use your information to maintain complete privacy.

Trusted by Indians

Our international money transfer service is used and trusted by 1000s of Indians across the world.

Get The Best International Money Transfer Online Rates with Remigos

5,00,000

5,193.66

1GBP = 95.39 INR

mid-market rate (as on 20th June 2020)

Exchange Rate

95.39

Transfer Fee

₹4576.82

Recipient Gets

5193.66

Exchange Rate

95.39

Transfer Fee

₹8812

Recipient Gets

5149.12

Exchange Rate

97.63

Transfer Fee

₹1000

Recipient Gets

5111.33

Now Send Money From India to UK From Your Smartphone!

Money Transfer From India to UK At The Best Rates

Receive Funds Within 12 to 24 Hour

Fully Digital Process

Lowest Transfer Fees In The Market

What Can You Do With Remigos Money Transfer Service?

Pay for Overseas Education

Send Money to Friends and Relatives

Keep A Track of All Your Transfers

The Remigos Advantage Over Other Remittance Providers

Lowest Transfer Charges

Remigos is one of the few online platforms in India that enables customers to make international money transfers at lowest transfer charges. We offer customers the convenience of booking their currency transfers at competitive rates.

Live Market Rates

Unlike banks who offer currency exchange at fixed rates for the day, Remigos provides live rates of INR to GBP on its money transferpage. This allows money transfer from India to UK at best rates. .

Fully Digital Remittance Process

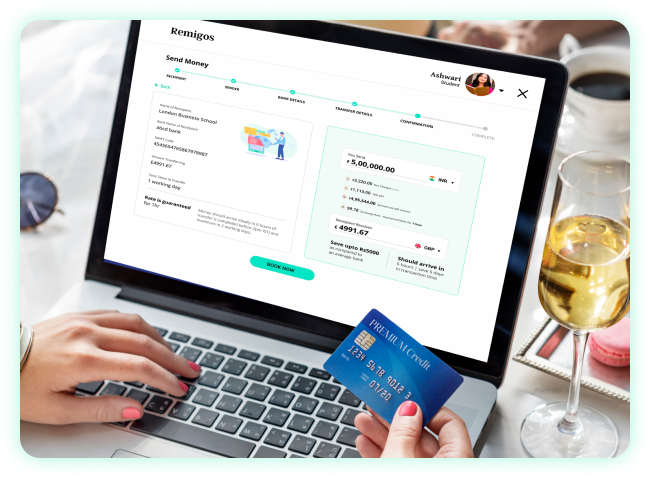

Remigos offers a fully online remittance process that allows you to complete your remittance in a fraction of a second. This means that you no longer have to wait in long queues at the bank.

Quick Transfer Processing Times

At Remigos, all international transfers are processed within 24 hours of booking. We can help you to transfer funds from India to the UK in just a few hours.

Send Money From India to UK With Remigos

Are you struggling to transfer funds from your Indian bank account? Does your bank impose high transaction fees when it comes to outward remittance? Well, all you need to do is sign up with Remigos! We can make international money transfer from India to UK simple, cheap and straightforward so that you don’t have to worry about visiting your bank ever again. You can enjoy a money transfer from India to UK in just a few clicks!

Why choose Remigos?

Remigos is one of the best digital marketplace for international money transfer from India. We offer secure, digital remittances through reputed partner banks in India. You can now send funds from India to UK 24×7 from the comfort of your home.

Remigos makes money transfer easier and affordable by offering competitive rates & deals. We also ensure that the money is transferred in the fastest time possible. You can now send money abroad directly through our digital platform. All you need to do is register your account!

The entire process is paperless and hassle-free. What’s best? You can send money from India to UK at the best rates in the market with minimal transfer fee. Whether you are a parent looking for a cheaper and easier way to send funds to your child or someone who wants to send money to their relatives in the UK, Remigos app can come in handy.

Benefits of Choosing Online Remittance Process on Remigos

A growing number of Indians are dipping their toes into foreign water. If you’re among them, you might be looking for a way to transfer money overseas. Remigos is a leading online money transfer portal that allows you to transfer money abroad at affordable rates. We also offer full transparency and no hidden charges.

Safe and Secure

With money transfer scams increasing at a fast pace, it is important to choose a reliable platform that provides top-end security. Remigos is one such platform that ensures the maximum security of money transfer from India to UK.

Digital & Paperless Process

With Remigos, you don’t have to worry about any paperwork when sending funds abroad. You can simply open the app, enter transfer details and send money from India to UK. The entire money transfer process is digital and you can conduct transactions from the comfort of your home.

Transparent and Affordable Fees

Choosing a fully online remittance process on Remigos allows you to save money on the total cost of your transaction. Whether you are sending money to your kids abroad, to a friend or loved one, we offer the best rates.

Transfer Money to Multiple Countries

As a growing number of Indians are heading abroad for education, employment or simply to improve their quality of life, remittance is a common option. With Remigos, you can enjoy money transfers from India to different foreign locations like the UK, USA, Australia, Europe, New Zealand, Canada, and Singapore.

Frequently asked questions

Yes, you can certainly send money from India to UK without any hassle. There are a number of ways in which you can legally transfer funds. These include bank transfers, specialist money transfer services, e-wallets and physical money remittance stores. However, if you are looking for the safest, fastest and cheapest money transfer from India to UK, check out Remigos. Our money transfer service is regulated by the RBI and is fully digital. And to top it all, we offer 5x more competitive rates than the market without any hidden fees. With Remigos, you can also send money from UK to India. We offer banking services at zero monthly fees and tons of benefits. Remigos is the best bank for international students in UK.

There are a number of different ways for money transfer from India to UK. Some people prefer to use a bank for their transfers, while others choose to rely on money transfer services. Using a bank for your international transfers can be a good option for some people, as they are under strict regulations. However, banks charge high fees for international transfers. So, if you want to save money but still enjoy a secure transfer, use Remigos. We provide you with a fast and easy solution to transfer money from India to the UK. Here is how you can send money from India to UK with ease.

Register an account with Remigos for free

Verify your identity

Add the recipient’s bank account details

Enter the amount and make the transfer

Track your transfer

There are many ways to send money from India to UK, and the cheapest ones usually involve specialist money transfer services. These can be faster and cheaper than bank wires. Remigos is an international money transfer service that offers a fast, simple and secure way to send money overseas. We allow you to choose your recipient’s country of residence and receive the method and pay for the money transfer from India to UK with your bank account. What’s best? We offer 5x superior rates than the market. Compared to most banks and money transfer services, you can enjoy the best exchange rate and lower transfer fees with Remigos. There are no hidden fees as well.

When it comes to money transfer from India to UK, there are certain charges that you have to pay, i.e. GTS, exchange rate and money transfer fee. The fees that remittance providers charge for their services can make or break your international money transfer. It’s a good idea to check the complete charges of the exchange rates to choose the best service. While there are many remittance providers that claim to offer money transfers with zero charges, it is mostly a gimmick. They offer higher exchange rates to make up for the transfer fee. So, make sure you check all the hidden charges when choosing a money transfer service.

Apart from checking the exchange rate and transfer fee, you also need to check how much money the recipient will get. It will help you to compare and choose the best money transfer service. While Remigos doesn’t offer free money transfers, the exchange rate and transfer fee are fixed in such a manner that the recipient will receive a higher amount than that with any other money transfer service. So, if you want to send money from India to UK with Remigos, click here.

In India, there are several regulations that are set forth by the Reserve Bank of India (RBI) when it comes to outward remittance. So, you cannot send money to high-risk countries indicated by the Financial Action Task Force (FATF). The list of the countries where outward remittance is not permitted gets updated from time to time.

Under the LRS (Liberalized Remittance Scheme), there are no restrictions on the frequency of remittance during a financial year. It means you can conduct a money transfer from India to UK’ n’ number of times.

If you’re transferring large amounts of money, it’s probably best to use a money transfer provider that specialises in remittances. At Remigos, we can help you with a large money transfer from India to UK without any hassle. We offer better INR to GBP exchange rates than your bank will and will charge much less for your remittance. Simply register your account, complete a one-time KYC, enter the recipient’s details and send money from India to UK from the comfort of your home.

Remigos is a safe and secure way to send money from India to UK. It is a technology-led, fully online remittance service that offers better forex rates than banks and other money transfer companies. Our services are regulated by the RBI, and we use authorised banks in India to transfer funds. All our online transactions are processed over a secure HTTPS connection, and we use 2-factor authentication for security purposes. So, you can rest assured when using Remigos money transfer from India to UK.

Yes, you have to pay 5% TCS on money transfer from India to UK if the amount is more than 7 lakh INR. However, if you are taking a loan to fund overseas education, the TCS will come down to 0.5% on any amount exceeding 7 lakhs INR.

The cost of money transfer from India to UK differs as per the remittance provider. The cost includes the exchange rate, transfer fee and GST. At Remigos, the entire process to send money from India to UK is digital and transparent. There is no hidden fee, and you just have to pay a nominal transfer fee.

If you want to enjoy a money transfer from India to UK via Remigos, you need to enter a few beneficiary details like,

Beneficiary bank name

IBAN sort code and Swift code

Beneficiary name and address

Purpose of the remittance

Amount of transfer

Hear what others have said

Other Countries Where You can Send Money

In the News

Supported By