International Money Transfer Made – Affordable, Faster, Easier and More Secure

Pay your tuition fees

Pay your university fees easily from your Indian bank account

Send money to an International Bank

Send money to an International Bank

Settle your Rent

Now pay rent to your landlord directly from your account in India

Why Choose Remigos for International Money Transfer?

Save Money With Best Rates

Get 5X superior rates than the market and save money.

No Paperwork, Fully Digital

No need to print out forms or visit banks

Super Fast Transfer

Whether you are sending $100 or $50,000, get in in just 24 hours.

No Hidden Fees

No more gimmicks or getting fooled by banks. Pay what you see.

100% Safe and Secure

Trusted by 1000s. Regulated by RBI. Guaranteed by us.

Hassle-Free Transaction

Super easy to use platform and 24*7 customers support available.

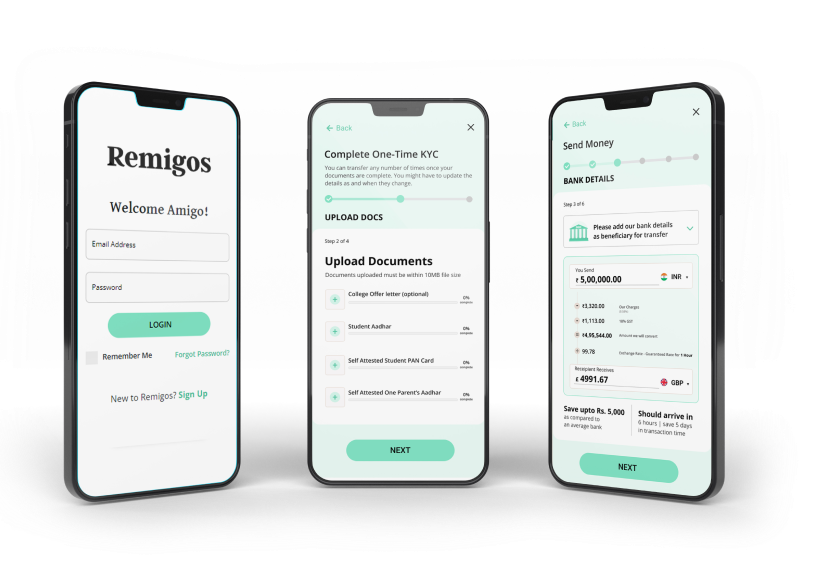

4 simple steps and you are all set

Register in minutes

Sign up online, or on our app with an email address.

Verify your Identity

We’d just need your PAN card, Passport, Visa and College offer letter to verify your identity.

Transfer Money

Fill in the details of your recipient’s bank account and pay using bank transfer.

Register in minutes

Sign up online, or on our app with an email address.

Enjoy Safe and secure Money Transfer with Remigos

RBI Regulated

We are RBI regulated and supported by SBM bank to provide safe and secure money transfer services.

Audited Regularly

Your money is safe with us. We are regularly audited by RBI to safeguard your money.

Covered in Media

It's great to get recognized by London Business School, Indian Startup News and many more for the amazing work we are doing.

Extra-Secure Transactions

At Remigos, no one ever touches your money. You pay it directly to bank and its on the way to its destination.

Data Protection

Your personal data is always encrypted. We are transparent in how we collect and use your information to maintain complete privacy.

Trusted by Indians

Our international money transfer service is used and trusted by 1000s of Indians across the world.

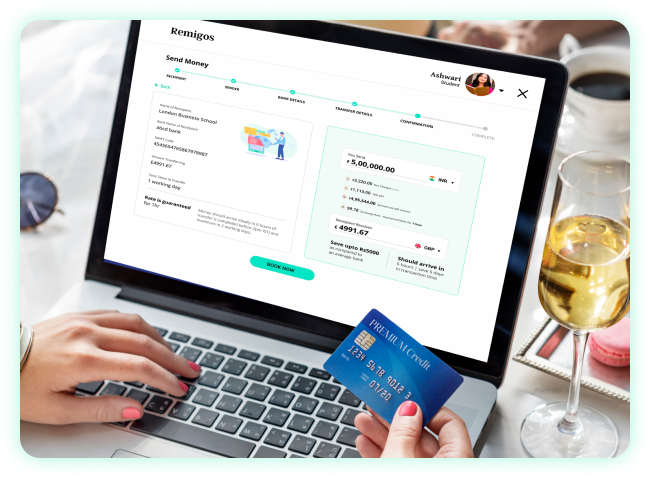

Get The Best International Money Transfer Online Rates with Remigos

5,00,000

5,193.66

1GBP = 95.39 INR

mid-market rate (as on 20th June 2020)

Exchange Rate

95.39

Transfer Fee

₹4576.82

Recipient Gets

5193.66

Exchange Rate

95.39

Transfer Fee

₹8812

Recipient Gets

5149.12

Exchange Rate

97.63

Transfer Fee

₹1000

Recipient Gets

5111.33

Frequently asked questions

Sending money abroad can cost you an arm and a leg, especially if it’s a large-value transaction. Fortunately, digitalization has opened doors for new affordable ways to send money internationally.

Gone are the days when you had to visit the bank, stand in long queues and waste time on unnecessary paperwork for international money transfers. Now, you can easily send money abroad in a jiffy from the comfort of your home with Remigos.

We are a UK-based money transfer company that allows Indians to send money to the UK at nominal fees. Our service is especially helpful for Indian students studying abroad in the United Kingdom. Instead of sending money through a bank and wasting hundreds of British Pounds and Rupees, you can simply take advantage of Remigos international money transfer service.

Our payment systems offer real exchange rates and lower transfer fees to save your hard-earned money. Remigos is an affordable, fast, efficient and secure way to transfer money internationally. Unlike most financial institutions, we are completely transparent about the fees. In addition, we have no minimum transaction requirements or monthly service fees. You can simply download our app on your smartphone and send money whenever you want.

If you are living in India but would like to send money abroad, you can do so with Remigos. We can help you to transfer money in minutes and get your funds delivered within 24 hours. Whether you want to send money to your loved ones overseas or pay your bills, it is an easy and convenient way to do so. All you need to do is follow these five simple steps.

Step 1: Register Your Account

To get started, you need to sign up online with Remigos. You can use your email address for quick registration. You can even use our app to sign up for an account.

Step 2: Verify Your Identity

The next step is ID verification. We just need a few documents like Passport, PAN card, Visa, and College offer letter to verify your identity. It takes about 2 hours to get those verified on a working day. Once it is done, you are all set for an international money transfer from India.

Step 3: Setup a Transfer

For international money transfers, you need to enter the details of your recipient’s bank account. Apart from that, you also need to tell us why you are transferring funds. It is a simple process like adding a beneficiary for a money transfer.

Step 4: Pay for Your Transfer

Now, all you need to do is pay for your transfer. You can add our bank details to your bank’s net banking. You can then initiate a NEFT or RTGS or even use UPI to pay money. Once we receive funds from your bank, we will send them to your recipient.

Step 5: Track

Easily track your transfer. Check if we have received the money, and if we sent it to the recipient, You can download a transaction copy which you can use as a proof to send to your recipient. You can also get real-time updates on email and Whatsapp.

We just need a few documents like Passport, PAN card, Visa, and College offer letter to verify your identity. Once it is done, you are all set for an international money transfer from India.

Be it money transfer to the UK, the US or any other country, we follow strict regulations set by governmental agencies in every country we operate in, so you can be certain that your money will reach its intended destination. You can view the details of the recipient account you entered by downloading a transfer receipt.

You can transfer upto $250,000 from one person’s bank accounts in a year. This limit is as per LRS given by RBI.

It generally takes 24 hours to get the money, but in certain banks or countries, it can take upto 72 hours also.

You can easily pay your university or college tuition fees in the UK easily from your Indian bank account with our international money transfer service. Quickly checkout the steps to transfer money to your university bank accounts on our website at http://remigos.indothai.co.in/money-transfer.

Enjoy international money transfer from India to get funds directly in the UK easily in just a few clicks. Steps to follow: 1. Sign up with a valid email id.

2. Verify your identity using a valid documents

3. Fill the recipient’s bank account details with reason of transferring money

4. We will send the money to your recipient’s account once we receive your bank transfer.

To pay your bills in foreign country, you can open international bank account using Remigos. Then just sign up on the platform, enter your new international bank details and complete the transfer. Directly pay your telephone and utility bills from your new bank account using Remigos international money transfer from India.

Now you can pay rent from your bank account in India to your landlord directly with an international money transfer from India. You can sign up on Remigos, complete your KYC, add your landlord’s bank details and pay him/her directly. Remigos can help in transferring your hard earned money at an affordable exchange rate. You can only pay the landlord’s personal account. We don’t permit you to pay the landlord’s company or a property manager yet.

You can send money from either your own account or you can use your family members account as well like your parents, siblings or partner/spouse. You can do all this with just one powerful Remigos account. You don’t need to create separate accounts for each payer.

You can either pay into your own bank account in foreign country or you can pay the university account. You can also pay the landlord directly but we still don’t allow paying you to a property manager.

Tax collection at source or TCS refers to an additional amount of tax that is collected by the seller or service provider from the buyer during the sale or transaction. This money is then deposited into a government account and the buyer gets credit against their tax liability, in case of foreign remittance.

For every remittance above INR 7 lakhs a 5% TCS will be deducted. This is according to the RBI’s Liberalized Remittance Scheme (LRS). If the money you are transferring is from student loan, then TCS is reduced to 0.5%.

Yes, you can claim a TCS refund.

No TCS is paid to the government and is deposited with your PAN account. You can either claim a refund or use the TCS against your tax liability for that year.

We are as safe as your locker. We care about you and safety of your money is our first priority. We are registered with RBI and our RBI license number is (BPL)|49|05.01.069|2022-23. You pay money to a registered bank and no one can touch that money. It is directly sent to the bank details you provide us.

Hear what others have said

Other Countries Where You can Send Money

In the News

Supported By